Year-to-Date Victoria Real Estate Market Update

As we enter the 2025 Victoria Real Estate market, many clients are asking whether prices will rise, what inventory levels will look like, whether they should sell now, and when the best time to buy is.

While we can’t predict the future, here’s a snapshot of the 2024 Real Estate Market and some tips to help you prepare if you plan to buy or sell property in Greater Victoria in 2025.

Victoria’s market remained largely resilient in 2024, with a total of 6,893 properties sold, representing an 11% increase from the 6,207 sold in 2023. The market has stayed strong despite global uncertainties, supported by declining interest rates and its reputation as a top lifestyle destination for Canadians.

In December 2023, the benchmark price for a single-family home in the Victoria Core was $1,272,000. By December 2024, this benchmark value had increased by 2.7% to $1,306,400, which was up slightly from November’s value of $1,302,900. For condominiums in the same area, the benchmark price was $556,500 in December 2023, but it decreased by 1.6% to $547,800 in December 2024, although it showed a 0.6% increase from November’s value of $544,400.

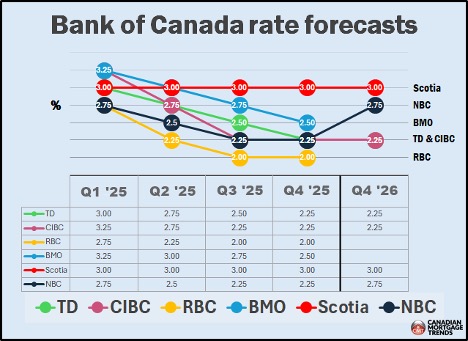

Throughout 2024, the Bank of Canada cut interest rates five times, with the last reduction of 0.50 basis points announced on December 11, 2024. Lower interest rates make borrowing more affordable and are likely to encourage more buyers to enter the market. Current five-year fixed mortgage rates are around 4%, significantly better than last year, which could lower costs for homebuyers and those renewing their mortgages. Robert Kavcic, Director and Senior Economist for BMO Capital Markets, predicts that mortgage rates will remain around or dip below 4% as the year progresses, barring any major disruptions in the broader economy, such as risks associated with U.S. tariffs.

According to Canadian Mortgage Trends, the majority of Canada’s big six banks forecast rate reductions this year, with only two expecting higher policy rates as we approach 2026.

Additionally, insured mortgage holders can now switch lenders at renewal without needing to requalify under the stress test, increasing flexibility and fostering competition. As of December 15, 2024, the price cap for insured mortgages has risen from $1 million to $1.5 million, enabling buyers to purchase higher-value properties with smaller down payments.

What Does This Mean for You?

– For Home Buyers: Lower interest rates and a raised cap on insured mortgages could increase affordability and bring previously sidelined buyers back into the market.

– For Home Sellers: With buyer demand expected to rise, we anticipate an early and active spring market in 2025.

In 2024, the Residential Property (Short-Term Holding) Profit Tax Act was also announced. Effective January 1, 2025, anyone in British Columbia selling a home within one year of purchase will face a 20% tax on their profit. After 18 months of ownership, this rate drops to 10%, and it reaches 0% after more than two years. While this measure aims to curb speculative flipping, some experts warn it could also impact homeowners forced to sell due to unforeseen life circumstances—despite the existence of certain exemptions for life events. Individuals experiencing job loss, family expansion, or separation may need legal and accounting advice to navigate this new tax. If you have questions about how this policy might affect you, Audra and Robert are available to discuss your concerns and refer you to professional advice as needed.

If you plan to sell, start preparing now to get ahead of the busy spring season. Clean up fallen leaves and tidy the landscaping to ensure a welcoming exterior in early spring. Moreover, minor repairs and a fresh coat of paint can enhance your home’s appeal without causing undue stress later. If you would like recommendations on affordable updates to help sell your home and/or a complimentary market valuation please reach out, we are here to help.

Next year could bring several potential changes. New developments may be proposed to increase housing supply, particularly in the pre-sale market, providing more options for families in line with the province’s and municipalities’, including Victoria’s, Missing Middle initiatives. The Federal election, scheduled for fall 2025, could further influence housing policies and market dynamics. That said, with its mild climate, vibrant culture, and proximity to nature, Victoria remains a top destination, drawing not only Canadians returning home but also buyers seeking stability and quality of life.

Thank you for trusting us with your real estate needs—we look forward to connecting with you in 2025

Warm regards,

Audra & Robert

The Victoria Pros Real Estate Team

For more statistics on the Victoria real estate market – click on the links to the right for the latest reports and data from the Victoria Real Estate Board, the British Columbia Real Estate Association, the Canadian Mortgage and Housing Corporation and the Canadian Real Estate Association.