Understanding the Offer Process When Purchasing a Home in Victoria, BC

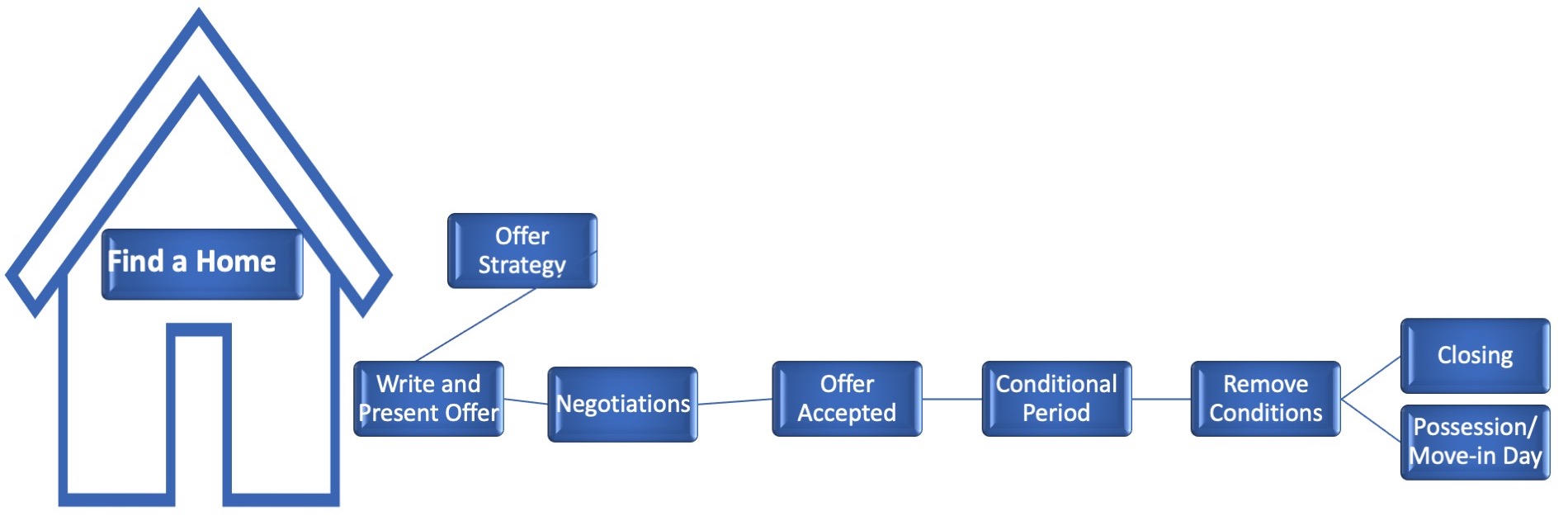

As most people don’t buy homes all that often, we are often asked how one makes an offer on a house. As such, we thought it would be useful to review the basic steps involved in the home buying process from putting together an offer on a property, through to taking possession of the house, condo, or any other type of property you may be considering buying on Vancouver Island.

How long will it take to buy a home in Victoria?

When it comes to finding the right home, everyone has a unique timeline. Some people find their choice property after viewing only a few homes, while other people may take months or even years to find the house or condo that really “fits” their lifestyle. We have had clients from out of town who diligently followed the Victoria Real Estate market on our home search tracking system for a few years, before they were ready to relocate to Victoria.

Once I have found a home to buy, what are the next steps?

Once you have decided on a property and are ready to write an offer, we will sit down to discuss the terms of the offer to be written. This discussion usually starts with a review of recent comparable home sales and comparable properties currently on the market.

We talk about the basic terms of the offer such as purchase price, deposit, closing dates, inclusions, time for acceptance, conditions, and how many days you as the home buyer will have to satisfy the conditions. We will also discuss any other terms that should be included in the offer based on the property you are considering purchasing and whether or not you will be in a multiple offer situation.

What should my offer price be on a home I want to buy?

Although there are exceptions, the purchase price is the part of the offer that is usually the most near and dear to home buyers and home sellers. So, it normally generates the most discussion when preparing an offer. The offer price depends on a great many factors, but typically starts with us reviewing recent sales of similar homes in the area with you. When we are acting for home buyers, our job is to secure the property for our clients on terms most favourable to you, including purchase price.

How much of deposit to I need to make when purchasing a home in Victoria?

The deposit is always the subject of discussion in preparing an offer. As a matter of law, the deposit can be any amount. Some home sellers are happy with a modest deposit. Some sellers prefer a larger deposit as they see it as an indication of the buyers’ good faith and creditworthiness. In addition, the amount of deposit desired by the sellers may often vary depending on how far out the closing occurs. (The “closing” is when the buyer pays for the property, gets title and takes possession). Generally speaking, if it’s a quick closing, such as 30 days, sellers are more likely to be satisfied with a smaller deposit than if the closing is four months out. The amount of the deposit will also vary depending on the type of offer being made. The deposit can be an important part of an offer.

Another reason that some sellers prefer a larger deposit is because they may view the deposit as a source of damages should the buyers default. The likelihood of a home buyer defaulting is extremely remote. We’ve never had a buyer or a seller default in all the years of our practice.

While there is no set standard, the general practice in the Victoria Real Estate Market is to make the deposit payable within 24 or 48 hours of removal of your conditions (e.g., inspection, financing, etc.) Although sometimes we may advise on a different approach depending on the property.

Deposits are typically held in trust by the buyer’s Realtor’s brokerage and are applied to the purchase price at closing.

How do I decide on closing and possession dates when buying a home?

There are three “closing dates” in a standard Victoria Real Estate Board contract of purchase and sale. Occasionally, all three dates are the same, however, sometimes they are not for various reasons.

- The Completion Date: This is the date that the home buyer pays the purchase price and gets title to the property.

- The Possession Date: This is the date that the buyers get the keys and take possession of the property.

- The Adjustment Date: This is the date that the home buyers become responsible for the various financial obligations associated with the property, such as property taxes and strata fees

In deciding what closing dates to put in a home offer, we look at what is ideal for you as the home buyers, compared to the dates the home sellers might prefer. If you can be flexible on your closing dates, it may make your offer more attractive to the sellers. This is especially the case when exact closing dates are of paramount importance to the sellers.

What are “Inclusions” in a contract to purchase a home and what do I need to know?

Any item that is not considered at law to be part of the real estate is not included with the purchase when a property is sold, unless the offer specifically provides for its inclusion. Things just sitting on, or in, the property, such as appliances and furniture, are not part of the real estate and are called chattels. If a buyer wants to acquire these chattels as part of the purchase they need to be specifically mentioned as “inclusions”.

Sometimes it’s very difficult to classify an item as part of the real estate or as a chattel. When I practiced real estate law, I once taught a course to bankers on the difference between fixtures and chattels. There is a two-part test to decide whether an item is a chattel or part of the real estate. Suffice it to say that the offer should clearly identify all chattels to be included with the purchase.

When will I know if my offer has been accepted?

When we are preparing an offer for a home buyer, we will discuss what we want to put in as the “Time for Acceptance”.

The Time for Acceptance is the period in which the sellers have to accept the home buyers’ offer. It can be a few hours, or it can be a few days. It all depends on the circumstances. In some situations, the time for acceptance can be very important. When a home seller receives an offer, they have three options. They can accept the offer. They can counter the offer. They can decide not to respond to the offer.

What conditions should I put in my offer when purchasing a home?

Except in extraordinary circumstances where the offer is to be unconditional, we will discuss what conditions are necessary and advisable to include in the offer for your protection. The number of possible conditions is unlimited, but the most common ones are mortgage financing, property inspection and title. In the case of strata properties such as condominiums and townhomes, the review and approval of the strata documents is one of the most important conditions.

What is the conditional period and how long will I have to remove conditions when I am purchasing a home?

The period from the date a contract is entered by the parties until the date the conditions (e.g., financing, home inspection, etc.) must be waived is called the “conditional period”.

In most offers, the conditions are for the benefit of the home buyer. Normally, during the conditional period, the sellers cannot accept another offer and “bump” the first home buyer, even if the second offer is higher. So, the sellers of the property have to wait until the buyers decide whether they wish to waive their conditions and proceed with the purchase. Because the sellers don’t know if the buyers will end up waiving the conditions, the sellers want to keep the conditional period as short as possible. On the other hand, when we are acting for a home buyer, we want to make sure that the conditional period gives you enough time to satisfy your conditions. Like everything else in the offer, the length of the conditional period is a matter of negotiation.

A home seller can continue to show their property until conditions are removed and can entertain and accept a back-up offer should they choose to do so. However a back-up offer does not bump the first offer, and only comes into play should the first position buyer, who is conditional, does not remove their conditions. One of the instances in which a home seller can bump an accepted conditional offer is when a buyer has a subject to sale , and they have not removed this subject. Whether you are looking to buy a home or are selling one, we can walk you through the pros and cons of subject to sale offers and discuss how to best protect your interests given your unique situation.

What needs to be done during the conditional period of the home buying process?

At the start of the conditional period, we provide our home buyers with a checklist of items to be completed before the conditions can be waived.

During the conditional period, apart from assisting our buyers in satisfying the conditions (i.e., coordinating inspections, liaising with mortgage brokers as necessary, etc.), we normally carry out due diligence on the property. This varies from property to property but, in the case of single-family homes, often includes title matters, zoning matters, reviewing permits such as building electrical and plumbing, archeological inquiry and bylaw violations inquiry. In the case of strata properties, our due diligence will normally include reading through the various strata documentation, including depreciation reports, building envelope reports, minutes of strata council meetings, annual general meetings and special general meetings, bylaws, rules, financials and the Form B. Our buyers will also be reading through these materials. The object of our due diligence is to give our home buyers additional information about the property, so that they can make an informed decision about whether they wish to waive the conditions and proceed with the purchase.

By the end of the conditional period, if our home buyers have satisfied the conditions and wish to proceed with the purchase, we will prepare a waiver of conditions document for you to sign. We then forward this to the sellers’ Realtor.

If you decide to not waive the conditions by the end of the conditional period (an example could be where the home inspection revealed serious structural problems with the home and you do not wish to proceed, a waiver of conditions document is not signed and the transaction is at an end. In this event, the parties normally sign a mutual release and the home sellers must look for another buyer and we will start helping you look for another home.

What is an Unconditional Contract?

It is important to understand that an unconditional contract is not the same as an unconditional offer.

An unconditional contract is when the home buyers’ conditions have been waived, and the parties have an unconditional contract. That means both the home buyers and home sellers are contractually bound to complete the purchase and sale. As mentioned above, the deposit is usually payable at this point. Once there’s an unconditional contract in place, we provide our home buyers with a checklist of items that they need to take care of prior to the closing. This includes such things as insurance, utilities, moving checklists, etc. We work with our clients every step of the way, so are often involved in assisting with various items that need to be taken care of prior to closing.

What needs to happen before the closing date?

Once the contract is unconditional, we will have our office send instructions to your lawyer or Notary so that they can prepare the documentation necessary to complete the purchase. The lawyers or Notaries are responsible for making sure that you get a proper title.

On the Possession Date, we will arrange to get the keys from the seller and meet you at your new home to hand them over.

We hope the above summary has given you some additional insight into the basic home buying process when it comes to writing an offer and what happens once your offer has been accepted.

When we first start working with a client, we provide them with a copy of a standard “Contract of Purchase and Sale” so you can review it, in advance, at your own pace. While additional terms and conditions may be added to protect your interests, reviewing the a standard Victoria Real Estate Board contract will give you time to ask any questions about any terms, clauses or other language that is unclear. This helps eliminate some of the stress, when it comes time to write an actual offer on a home, as you will understand what you are signing so that we can all focus on the negotiation strategy that will increase your chances of getting the house. This is particularly important when the real estate market is hot and there are time restraints on when offers will be reviewed.

If you have additional questions about the home buying process, whether it’s on back up offers, contingent offers, subject to sales, multiple offers or more, just contact us by phone or email.

Ready to Open a New Door?

Audra Poole brings a unique level of knowledge, experience and service that is hard to find. She is a skilled negotiator and a highly respected marketing and public relations executive with more than twenty-five years of local, regional and international experience.

Whether you are looking to buy or sell a home in Victoria, Oak Bay, Sidney, Saanich or on Vancouver Island – she’ll be on your side and make the process as stress free and seamless as possible.